unfiled tax returns 10 years

The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. Tax agencies time limit is specific to the state so.

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

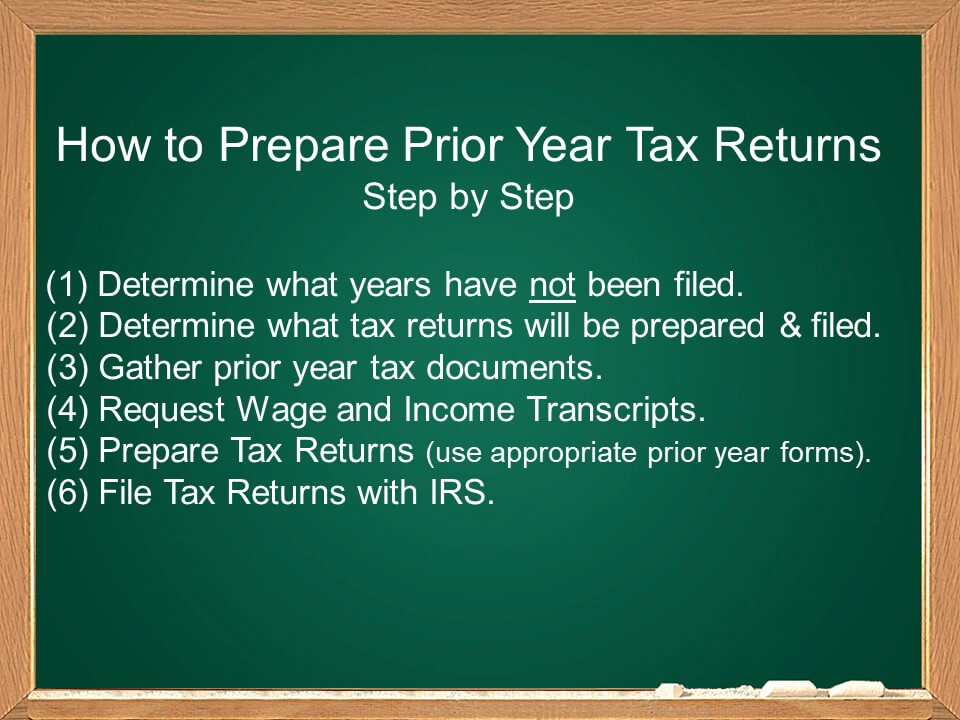

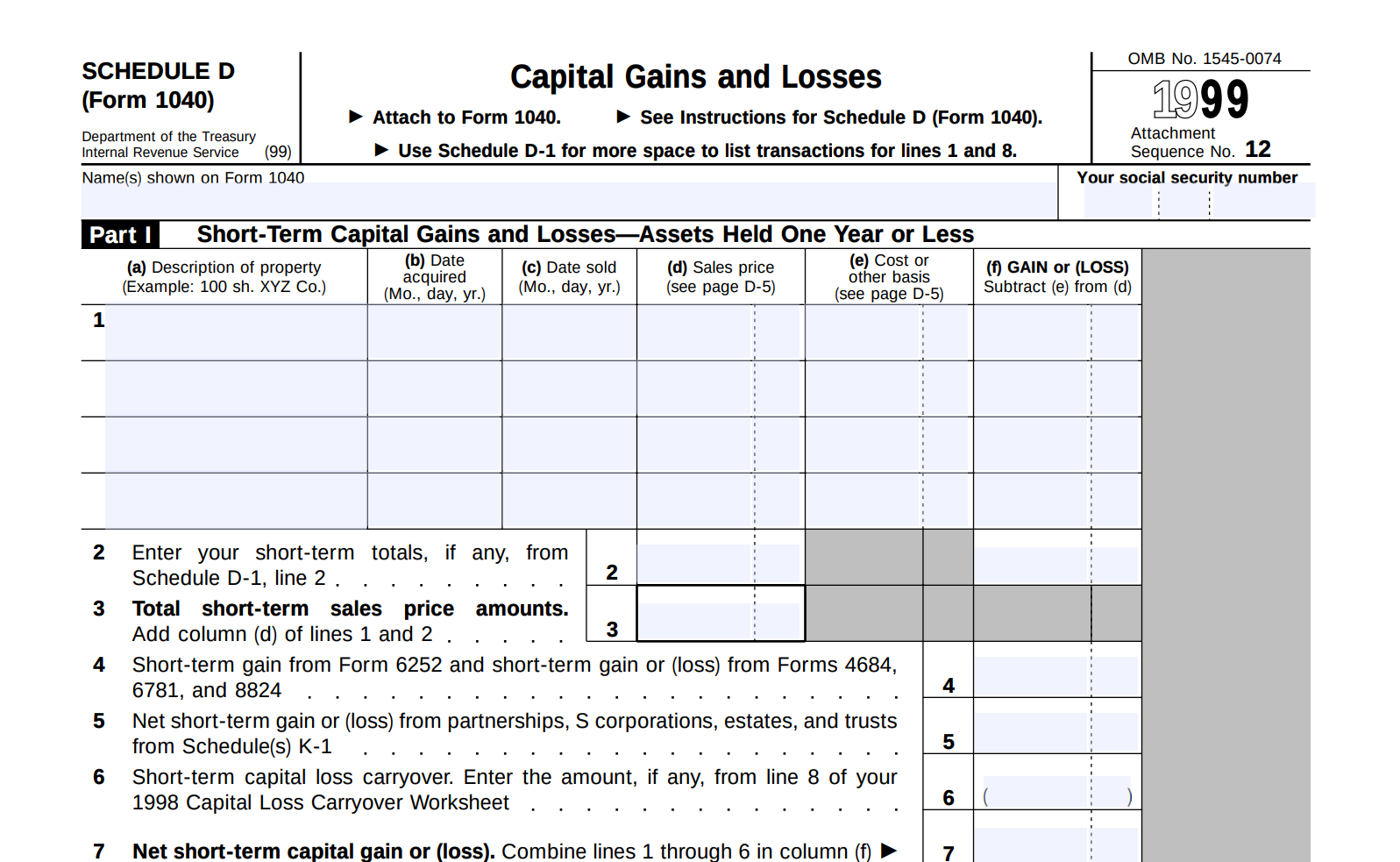

Prepare the Returns You cannot file an older year return using the current year tax forms and instructions.

. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. Get a Free Quote for Unpaid Tax Problems. Any information statements Forms W-2 1099 that you may.

While it is an IRS rule per se it isnt quite as simple as just dont pay your back taxes for ten years and then the. This is called the 10-Year Statute of Limitations. Based On Circumstances You May Already Qualify For Tax Relief.

Based On Circumstances You May Already Qualify For Tax Relief. If you havent done one of those things the. 2 days agoThe IRS will assess a 25 failure to file a penalty and up to a 25 failure to pay the penalty plus interest.

In fact youre only protected by a time limit if you file your taxes at which point the IRS only has 10 years to collect from the date you filed. Need Help Filing Back Taxes. However they can still come after you for any.

This article will discuss why you should file your. Keep in mind that you dont necessarily have to file every year. However in practice the IRS rarely goes past the past six years for non-filing enforcement.

Ad Get Back Taxes Help in 3 Steps. Ad 5 Best Tax Relief Companies of 2022. Figure Out Which Years You Need to File.

Ad Get Back Taxes Help in 3 Steps. End Your Tax Nightmare Now. Havent paid your taxes in 5 years.

Even if you cant pay just filing your return will save you significant time. Have unfiled tax returns. If you havent been filing your tax returns for years you could avoid a lot of trouble with the IRS by filing these old returns.

Have a tax debt of 30000 or more. Get a demo today. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

The statute of limitations on unfiled federal tax returns is three years. After that the debt is wiped clean from its books and the IRS writes it off. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further.

Here are 10 things you should know about getting current with your unfiled returns. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest. Unfiled tax returns 10 years Thursday September 8 2022 Edit.

After that the IRS can no longer prosecute you for not filing your taxes. Start with a Simple and Easy Free Consultation. Produce critical tax reporting requirements faster and more accurately.

This is because the tax law changes from year to year and some. Start with a Simple and Easy Free Consultation. Its not likely.

Sort out your unpaid tax issues with an expert. A copy of your notices especially the most recent notices on the unfiled tax years. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

Get free competing quotes from the best. Ad See If You Qualify For IRS Fresh Start Program. Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More.

The IRS only has ten years to collect from taxpayers but the clock doesnt start ticking until you file a tax return or the IRS files for you aka SFR. The penalty for not filing at all is x10 larger than the penalty for filing and then not paying. Bring these six items to your appointment.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Free Case Review Begin Online.

In most cases the IRS requires the last six years tax returns to be filed as an. In most cases the IRS requires you to go back and file. What Should I Do If I Havent Filed Taxes in 10 Years.

If your return wasnt filed by the due date including extensions of time to file. So always file even if you cant pay -- the penalty is larger that way. Ad Dont Face the IRS Alone.

The late fining penalty for a C-Corporation is 5 of the outstanding tax for up to five months. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. At MendozaCo we are here to help.

The minimum penalty is the smaller of the tax due or 135. Failing to file or pay for. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Unfiled Irs Tax Returns Best Tax Relief Company Is

Unfiled Tax Returns Premier Tax Solutions

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Astonishingly An Irs Non Filer Has 10 Of Unfiled Tax Returns

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

How Far Back Can The Irs Collect Unfiled Taxes

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq